Pennsylvania State Tax On Gambling Winnings

- Pa State Tax On Gambling Winnings

- Pennsylvania State Tax On Gambling Winnings Money

- Pennsylvania State Tax On Gambling Winnings Losses

Pennsylvania lawmakers deserve some credit for putting their state on the leading edge of this trend toward sports betting.

The legislature passed an enabling law last year, even before the US Supreme Court considered overturning the federal ban known as PASPA. That prohibition is no longer on the books, and Pennsylvania sports betting is legal pending final regulations.

Casino operators aren’t exactly lining up at the license office in anticipation, though. The specifics of the PA law leave a lot to be desired, clipping the industry’s wings before it even tries to fly.

Depending on the number of your winnings, your federal tax rate could be as high as 37 percent as per the lottery tax calculation. State and local tax rates vary by location. Some states don’t impose an income tax while others withhold over 15 percent. Also, some states have withholding rates for non-residents, meaning even if you don’t. Pennsylvania Tax Rate for Gambling Winnings Pennsylvania personal income tax is currently levied at the rate of 3.07 percent against taxable income, including gambling and lottery winnings. In addition to federal taxes payable to the IRS, Pennsylvania levies a 3.07% tax on gambling income. You should report your Pennsylvania taxable winnings on PA-40 Schedule T (PDF). Include the total winnings from line 6 of Schedule T on your Pennsylvania Income Tax Return PA-40 (PDF), line 8 (“Gambling and Lottery Winnings”).

As the saying goes, two things in life are certain: Death and high gambling taxes in PA. The state’s expansion into these new formats will be taxed at a rate that raises serious questions about sustainability. As the law is written, sportsbooks will have to pay 36 percent of their revenue back to state and local coffers. That is a ridiculous.

Here’s how Brett Collson put it on the most recent episode of TheLines podcast:

“Pennsylvania is kind of a wild card this year. The regulations for sports betting currently in place are… concerning.”

What’s wrong with them? We’ll explain.

PA gets aggro with gambling taxes

As the saying goes, two things in life are certain: Death and high gambling taxes in PA.

The state’s expansion into these new formats will be taxed at a rate that raises serious questions about sustainability. As the law is written, sportsbooks will have to pay 36 percent of their revenue back to state and local coffers. That is a ridiculous number.

Compare that to Nevada, which has been refining its industry for almost 70 years. Nevada sportsbooks return 6.75 percent of their revenue to the state, and things work just great. Operators make a little profit, the state collects tens of millions of dollars, and bettors get to do what they do in a regulated environment.

PA operators will pay more than five times the tax rate in Nevada, a serious disincentive for some operators.

Spokesman Eric Schippers says Hollywood Casino isn’t even sure it wants sports betting under those terms. “We haven’t made a final determination on whether to pursue what is the highest rate on the planet for sports betting,” he told Penn Live.

A couple states (like Delaware and Rhode Island) will offer sports betting through more lopsided revenue-sharing agreements with their lotteries. Those are exceptions to the rule, though. Most states are proposing something between 7-15 percent.

It’s also worth mentioning that the oppressive taxation won’t be limited to sports betting. PA will tax online slot revenue at 54 percent, more than twice the rate at which operators say they feel comfortable. Slot play accounts for around three-quarters of total online gambling revenue in existing markets.

By way of another comparison, New Jersey taxes online slot revenue at 17.5 percent.

A high bar to entry for casinos too

The recurring costs are unfriendly, but some operators might not even be able to squeeze in the door. Obtaining a PA sports betting license requires operators to overcome the tallest hurdle in any US market, existing or proposed.

Like tax rates, there is no state standard for licensing fees. As an example, Indiana recently considered a bill with a proposed fee of just $5,000. There are some big ones, too, including the $5 million suggested in one Illinois bill. In broad terms, a couple hundred thousand dollars seems to be within the range across most states.

PA sports betting licenses will cost $10 million apiece, though, larger than any other proposal. The tax rate makes the market unappealing from the start, and the up-front fee will be a dealbreaker for some properties.

As the smallest PA casino, Lady Luck Nemacolin is a good example. The property generated around $20 million in total revenue last year, so there’s almost no way it would front the money for a license. Its only real path to sports betting would involve a partnership with an existing operator.

It’s not just the little guys, though. Hollywood Casino tallied more than $100 million in revenue last year, and it seems to have a good foothold on its market. Still, giving away $10 million is not a high priority. Schippers said that if Hollywood does offer sports betting, it would try to do so on the cheap. “The state has strangled the goose on this one,” he said.

There’s also some disparity between the licensure for sports betting and other forms of online gambling. Casinos will pay $4 million for a license in each of these game types:

- Slot machines

- Table games

- Poker

While each of these separately cost $4 million, for $10 million, a property can purchase all three. So, casinos can spend the same amount of money to offer sports betting as they would to offer every form of iGaming.

So what? The state needs money

Yes, it certainly does. The fact that Pennsylvania has been operating under a budget shortfall is the only reason we even have a sports betting law to pick on.

This is the issue, though. Rather than viewing expanded gambling as an amenity for casinos, the state took it as an opportunity to plug its own leaks. Tax revenue is arguably the worst reason to allow expanded gambling, and that’s especially true for sports betting.

As any bookmaker (or bettor) will tell you, sports gambling has some of the tightest margins in the industry. Although bettors plunked down almost $5 billion last year in Nevada, sportsbooks earned less than $250 million, holding around five percent of the total “handle.”

In simple terms, operators earn about a nickel on every dollar bet. And Pennsylvania will take back almost two cents of that in taxes. That take will be counterproductive to what should have been the primary reason for legalization.

Sports betting is unique in that operators aren’t competing against each other as much as they are competing against offshore sites. There’s something like $150 billion wagered in the US each year, and almost all of it is done through black/gray channels. In order to provide a tempting alternative, the regulated industry must provide similar convenience and competitive lines.

Convenience won’t be a problem as long as there is mobile wagering, but competitive lines might be. If bookmakers want to be profitable in PA, they’ll almost certainly have to pad their lines. And if PA lines aren’t competitive, those in the know will just keep betting with “their guy.”

By writing their greed and shortsightedness into law, PA lawmakers are actually doing the unregulated industry a bit of a favor.

More Articles

Do you like to gamble? If so, then you should know that the taxman beats the odds every time you do. The Internal Revenue Service and many states consider any money you win in the casino as taxable income. This applies to all types of casual gambling – from roulette and poker tournaments to slots, bingo and even fantasy football. In some cases, the casino will withhold a percentage of your winnings for taxes before it pays you at the rate of 24 percent.

Casino Winnings Are Not Tax-Free

Casino winnings count as gambling income and gambling income is always taxed at the federal level. That includes cash from slot machines, poker tournaments, baccarat, roulette, keno, bingo, raffles, lotteries and horse racing. If you win a non-cash prize like a car or a vacation, you pay taxes on the fair market value of the item you win.

By law, you must report all your winnings on your federal income tax return – and all means all. Whether you win five bucks on the slots or five million on the poker tables, you are technically required to report it. Job income plus gambling income plus other income equals the total income on your tax return. Subtract the deductions, and you'll pay taxes on the resulting figure at your standard income tax rate.

How Much You Win Matters

Pa State Tax On Gambling Winnings

While you're required to report every last dollar of winnings, the casino will only get involved when your winnings hit certain thresholds for income reporting:

- $5,000 (reduced by the wager or buy-in) from a poker tournament, sweepstakes, jai alai, lotteries and wagering pools.

- $1,500 (reduced by the wager) in keno winnings.

- $1,200 (not reduced by the wager) from slot machines or bingo

- $600 (reduced by the wager at the casino's discretion) for all other types of winnings but only if the payout is at least 300 times your wager.

Pennsylvania State Tax On Gambling Winnings Money

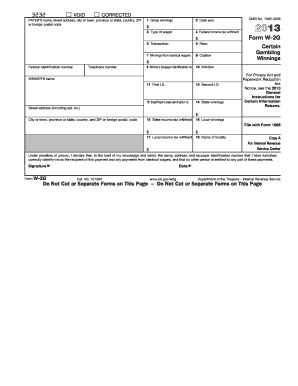

Win at or above these amounts, and the casino will send you IRS Form W2-G to report the full amount won and the amount of tax withholding if any. You will need this form to prepare your tax return.

Understand that you must report all gambling winnings to the IRS, not just those listed above. It just means that you don't have to fill out Form W2-G for other winnings. Income from table games, such as craps, roulette, blackjack and baccarat, do not require a WG-2, for example, regardless of the amount won. It's not clear why the IRS has differentiated it this way, but those are the rules. However, you still have to report the income from these games.

What is the Federal Gambling Tax Rate?

Standard federal tax withholding applies to winnings of $5,000 or more from:

- Wagering pools (this does not include poker tournaments).

- Lotteries.

- Sweepstakes.

- Other gambling transactions where the winnings are at least 300 times the amount wagered.

If you win above the threshold from these types of games, the casino automatically withholds 24 percent of your winnings for the IRS before it pays you. If you cannot provide a Social Security number, the casino will make a 'backup withholding.' A backup withholding is also applied at the rate of 24 percent, only now it includes all your gambling winnings from slot machines, keno, bingo, poker tournaments and more. This money gets passed directly to the IRS and credited against your final tax bill. Before December 31, 2017, the standard withholding rate was 25 percent and the backup rate was 28 percent.

The $5,000 threshold applies to net winnings, meaning you deduct the amount of your wager or buy-in. For example, if you won $5,500 on the poker tables but had to buy in to the game for $1,000, then you would not be subject to the minimum withholding threshold.

It's important to understand that withholding is an entirely separate requirement from reporting the winning on Form WG-2. Just because your gambling winning is reported on Form WG-2 does not automatically require a withholding for federal income taxes.

Can You Deduct Gambling Losses?

If you itemize your deductions on Schedule A, then you can also deduct gambling losses but only up to the amount of the winnings shown on your tax return. So, if you won $5,000 on the blackjack table, you could only deduct $5,000 worth of losing bets, not the $6,000 you actually lost on gambling wagers during the tax year. And you cannot carry your losses from year to year.

The IRS recommends that you keep a gambling log or spreadsheet showing all your wins and losses. The log should contain the date of the gambling activity, type of activity, name and address of the casino, amount of winnings and losses, and the names of other people there with you as part of the wagering pool. Be sure to keep all tickets, receipts and statements if you're going to claim gambling losses as the IRS may call for evidence in support of your claim.

What About State Withholding Tax on Gambling Winnings?

There are good states for gamblers and bad states for gamblers. If you're going to 'lose the shirt off your back,' you might as well do it in a 'good' gambling state like Nevada, which has no state tax on gambling winnings. The 'bad' states tax your gambling winnings either as a flat percentage of the amount won or by ramping up the percentage owed depending on how much you won.

Each state has different rules. In Maryland, for example, you must report winnings between $500 and $5,000 within 60 days and pay state income taxes within that time frame; you report winnings under $500 on your annual state tax return and winnings over $5,000 are subject to withholding by the casino due to state taxes. Personal tax rates begin at 2 percent and increase to a maximum of 5.75 percent in 2018. In Iowa, there's an automatic 5 percent withholding for state income tax purposes whenever federal taxes are withheld.

State taxes are due in the state you won the income and different rules may apply to players from out of state. The casino should be clued in on the state's withholding laws. Speak to them if you're not clear why the payout is less than you expect.

How to Report Taxes on Casino Winnings

You should receive all of your W2-Gs by January 31 and you'll need these forms to complete your federal and state tax returns. Boxes 1, 4 and 15 are the most important as these show your taxable gambling winnings, federal income taxes withheld and state income taxes withheld, respectively.

You must report the amount specified in Box 1, as well as other gambling income not reported on a W2-G, on the 'other income' line of your IRS Form 1040. This form is being replaced with a simpler form for the 2019 tax season but the reporting requirement remains the same. If your winnings are subject to withholding, you should report the amount in the 'payment' section of your return.

Different rules apply to professional gamblers who gamble full time to earn a livelihood. As a pro gambler, your winnings will be subject to self-employment tax after offsetting gambling losses and after other allowable expenses.